The Best From HOME LOANS

HOME LOANS is an experienced team that has been working in real estate for over a decade and especially with real estate loans for over 4 years (licensed for microfinance activities from the Russian Federation Finance Ministry from 2013) and in IT development for more than 5 years decided to create a HOME LOANS platform.

Currently, anyone over the age of 18 will have the opportunity to purchase their own home with just a smartphone and the HOME LOANS mobile app.

It is not surprising that financial institutions check the borrower's trust very wisely before lending money. Financial entities should make various procedures such as credit score, security investigation, and credit history checks in the Bureau (which are not free) to evaluate and make decisions regarding bank credit committees.

Reasons to create HOME LOANS platform

i. Economic level

ii. Refinancing rate

Iii. Internal bank regulations

iv. The default amount, the age of the borrower, etc.

i. Economic level

ii. Refinancing rate

Iii. Internal bank regulations

iv. The default amount, the age of the borrower, etc.

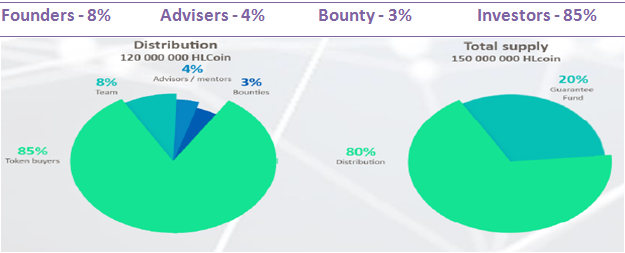

- Creation of an international platform for Peer-to-peer lending on the Etereum Block Chain, using our own GLCCurrency crypt to lend people to buy real estate worldwide with minimum interest rates from private investors without resorting to intermediaries in peer-to-peer sales and purchases P2P (peer-to-peer) transactions. Everyone who owns HLCoin is an investor.

- Peer-to-peer loans (or person-to-person loans, peer-to-peer investments, social loans, P2P loans) are loans to individuals by individuals without the involvement of traditional financial players such as banks.

- HOME LOANS will become an easily accessible financial platform whereby people from all over the world can turn their savings into real estate-backed HLCoin currencies to get a return on real estate loans, property purchases and their income protection from inflation.

- Due to opportunities for smart contracts and innovative financing platforms for real estate loans, HLCoin will reduce costs and increase the pace of traditional businesses in lending to real estate security and eliminating the need for third party participation.

COUNTRIES WHERE IT'S COMPLEX TO GET MORTGAGE

- Bulgaria

Fixed interest rate: 11%

Interest on loan: up to 70%

Loan term: up to 25 years. - Czech Republic

Fixed interest rate: 5%

Interest on loan: up to 60%

Loan term: up to 35 years. - Switzerland

Fixed interest rate: 4.5%

Loan interest: up to 50%

Loan term: up to 10 years. - Australia

Fixed interest rate: 3.5%

Interest on loan: up to 60%

Loan term: up to 25 years. - UK

Fixed interest rate: 2-4,5%

Interest on loan: up to 70%

Loan term: from 5 years.

The minimum amount of mortgage loans in Foggy Albion is £ 100,000, British banks do not choose to consider apps of less than £ 1 million. Such a loan to a financial institution is simply not profitable. As for the borrower, this situation is not good because the chances of getting a mortgage for an economy class apartment is much lower than if the fund is required to finance elite facilities. Officially, Russians can get a mortgage at an annual rate of 2 to 4.5% and a five year loan agreement with the possibility of further extension to the revised terms.

COUNTRIES WHERE IT MAY NOT BE POSSIBLE TO GET MORTGAGE.

- Thailand

Very often Asian countries including Thailand (popular among investors and downshifter) lend only to local residents. This means that to get a mortgage, the borrower must obtain a residence permit or even national citizenship first. - Netherlands

One of the conditions for obtaining loan approval in the Netherlands is the need to generate income in EU countries. If the applicant has this privilege then he has a chance, otherwise he should rely solely on his own resources. - Norway

Norway is clearly not the most popular country for foreigners to get a mortgage but if such a desire still appears the borrower must prove its earnings gained in the EU region. - Italy

The situation with mortgages is even more complicated in Italy. It is necessary not only to open an account with a local bank first and use it actively, but also to have real estate on the Apennine peninsula or in the eurozone. Some Italian banks provide loans only to citizens who have a valid residence permit. - Japan

There are several banks that specialize in lending to foreigners in Japan and in most cases to get a mortgage, are required to have permanent residence or even the nationality of the country.

Our Solutions

A. Creation of an international loan platform using open source resources based on chain block technology.

B. Provide private investors with access to large amounts of data.

C. Minimum 500,000 and maximum 50 million US dollars.

Original price: token price set at

1 US dollar level - 1 HLC token.

A. Creation of an international loan platform using open source resources based on chain block technology.

B. Provide private investors with access to large amounts of data.

C. Minimum 500,000 and maximum 50 million US dollars.

Original price: token price set at

1 US dollar level - 1 HLC token.

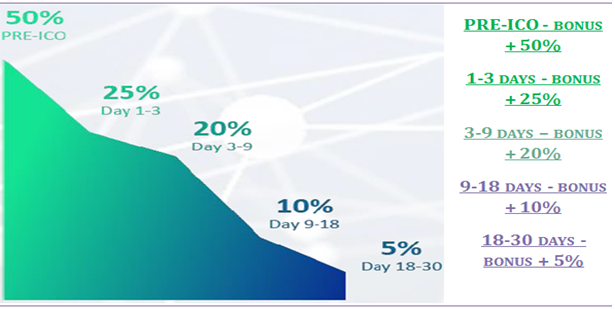

Bonus to First Investor during Initial Offering Token:

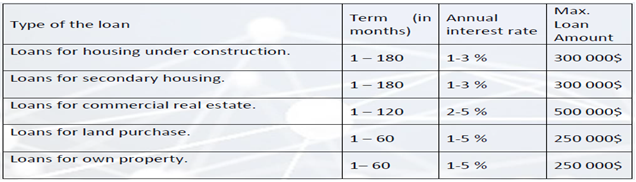

The international loan platform for real estate HOME LOANS provides loan types such as:

- Loans for housing under construction.

- Loans for secondary housing.

- Loans for commercial real estate.

- Loans for the purchase of land

- Loans for own property.

The borrower's age is above 18 and up to 65 years (at the end of the loan).

FORMULA FOR ANNUITY PAYMENT

According to the formula, the sum of periodic (monthly) payments is

A = K × S

Where,

A is the monthly annuity payment,

K is the annuity coefficient and

S is the loan amount.

According to the formula, the sum of periodic (monthly) payments is

A = K × S

Where,

A is the monthly annuity payment,

K is the annuity coefficient and

S is the loan amount.

The annuity coefficient is calculated using the following formula:

Where

I am the monthly interest rate on the loan (= annual rate / 12),

Where

I am the monthly interest rate on the loan (= annual rate / 12),

n is the number of periods in which the loan is paid.

If the interest rate is 4% per year then the monthly rate:

i = 4.2% / 12 months = 0.35%.

i = 4.2% / 12 months = 0.35%.

Calculation of annuity payments

Example of calculating annuity payments

Suppose 30,000 HLCoin is borrowed (at a cost of 1 $ pf 1 HLCoin) of 4.2% for a period of 10 years.

Solution

Initial data:

S = 30,000 HLCoin

i = 0.35% (4.2% / 12 months) = 0.00035

n = 120 (10 years 12 months)

We replace this value by the formula and determine the annuity coefficient:

0.00035 * (1 + 0.00035) ¹²⁰ / (1 + 0.00035) ¹²⁰- 1 = 0,008511016

Monthly payment:

A = K × S = 0.008511016 * 30000 = 255,33048 HLCoin

Example of calculating annuity payments

Suppose 30,000 HLCoin is borrowed (at a cost of 1 $ pf 1 HLCoin) of 4.2% for a period of 10 years.

Solution

Initial data:

S = 30,000 HLCoin

i = 0.35% (4.2% / 12 months) = 0.00035

n = 120 (10 years 12 months)

We replace this value by the formula and determine the annuity coefficient:

0.00035 * (1 + 0.00035) ¹²⁰ / (1 + 0.00035) ¹²⁰- 1 = 0,008511016

Monthly payment:

A = K × S = 0.008511016 * 30000 = 255,33048 HLCoin

CONCLUSION:

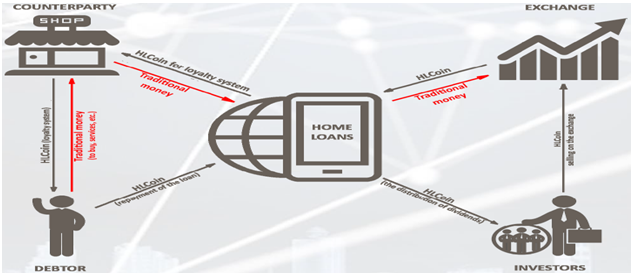

The opposite party receives the customer, the client receives the HLCoin token to repay the loan, and the traditional money is returned through our partner's loyalty system and then goes to HOME LOANS account to purchase HLCoin in exchange & return to the HOME LOANS system ecosystem.

Our goal is to help private investors and businesses working on blockchain technology to expand their client base significantly by accessing real estate lending and mobile marketing platforms for businesses.

The opposite party receives the customer, the client receives the HLCoin token to repay the loan, and the traditional money is returned through our partner's loyalty system and then goes to HOME LOANS account to purchase HLCoin in exchange & return to the HOME LOANS system ecosystem.

Our goal is to help private investors and businesses working on blockchain technology to expand their client base significantly by accessing real estate lending and mobile marketing platforms for businesses.

Official Website: http://home-loans.io/

Whitepaper Link: http://home-loans.io/White_Paper_ENG.pdf

Telegram Channel: https://t.me/homeloanscoin

Official Facebook Page: https: // www .facebook.com / HomeLoans-1718926604819378 /

Whitepaper Link: http://home-loans.io/White_Paper_ENG.pdf

Telegram Channel: https://t.me/homeloanscoin

Official Facebook Page: https: // www .facebook.com / HomeLoans-1718926604819378 /

Created by TahuDiniHari : https://bitcointalk.org/index.php?action=profile;u=1073216

Komentar

Posting Komentar