This Is SWARM, Come Join !

World economic system there are three kinds:

The Shariah Economic System is a social science that studies the economic problems of the people who are inspired by Islamic values. Sharia economy or cooperative economic system is different from capitalism, socialism, and

Welfare State

The Liberal / Capital Economic System is an economic system in which trade, industry and means of production are controlled by private owners with the aim of making a profit in the market economy. Owners of capital can make efforts to achieve maximum profit.

and the Economic System of Communism is an economic system in which the means of production are shared and used together. all economic aspects may be individually owned, provided that they may be used socially. (wikipedia)

Swarm Fund is a common platform to raise funds and be processed together.

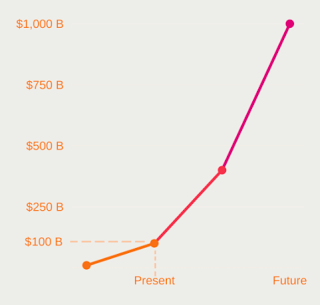

Swarm Fund is a new platform model based on Blockchain technology with an exceptional Ethereum smart contract. Revolutionize the economic system to work together with maximum results. Swarm Fund is an affiliate of the first successful WINGS Platform. The Swarm Fund provides new hope in managing the crypto economic system. The Swarm Fund team plans to help the Crypto World grow to $ 1 trillion by bringing real tokens of tokens through mutual funds.

Swarm offers a unique market infrastructure model that allows investing crypto assets into real assets, and applying traditional capital to the real market in new ways.

What a new thing in the crypto world, started from a virtual world to a real world in processing finances together. The technology model and blockchain used may also be useful for other vertical industries besides finance.

MISSION SWARM FUND

Swarm is a fully decentralized capital market platform built on fully-owned blockchain technology. Our vision is to allow anyone, anywhere in the world, to participate in value creation in the crypto asset category and to take advantage of newly purchased tokens, anything from real estate pressure to solar installations to rainforest conservation projects and more .

Swarm transforms financial opportunities from exclusive to inclusive. We provide empowerment, access, and tradability. Anyone can take part and their crypto funds work for them.

With Swarm We will:

. Opening the hands or beginners of crypto investors participate in the creation of a wealth

composition from the results utilizing crypto money

. Create a viable framework and relationship for crypto investors for alternative investments. Asset-

backed opportunities in sequential order to avoid market votality

. Introducing new liquidity alternatives for attractive project owners who attract the economy to seek

capital and engagement with the investor community

Core Objective: Follow The Experts

Swarm allows experts to run their own projects and deal opportunities with no middlemen involved. We are building an ecosystem of experts with a kind of edge (track record, trading ability, unique data, unique deal access, etc.) to allow crypto investors to follow and co-invest with them. This changes the mechanics of the traditional fund / GP model, as investments can be as large or small as the investors want them to be, and they can operate the fund structures very flexibly. Also, it breaks up the syndicates of gatekeepers and rigid structures of institutional capital as it is deployed today. Core Objective: Combine Token Flexibility With Real Opportunities Crypto investors have appreciated the flexibility and market-making function that tokenization has introduced. Tokens and their underlying smart contracts represent the ultimate opportunity of two parties to come together and interact without middlemen. Part of that is the freedom to trade or co-own tokens. That is the freedom we want to bring to any kind of asset class. When a participant likes an opportunity to run on the project grow grows. At the same time, all the projects become tradable asset-backed tokens. Participants can buy or sell these tokens whenever they want, and they decide how long to engage. All trades are made using blockchain technology, making them fast, transparent and secure

Swarm Applications

With the Swarm investment platform serving as a technology reference framework as well as a global liquidity hub, decentralized application developers will be able to create new classes of investment assets that can be used in any number of simple or complex applications. The following section lays out defining characteristics of asset classes in which to pilot the Swarm Platform, followed by subsequent sections that highlight the number of uses cases that have been deployable using the Swarm Platform

FINANCES

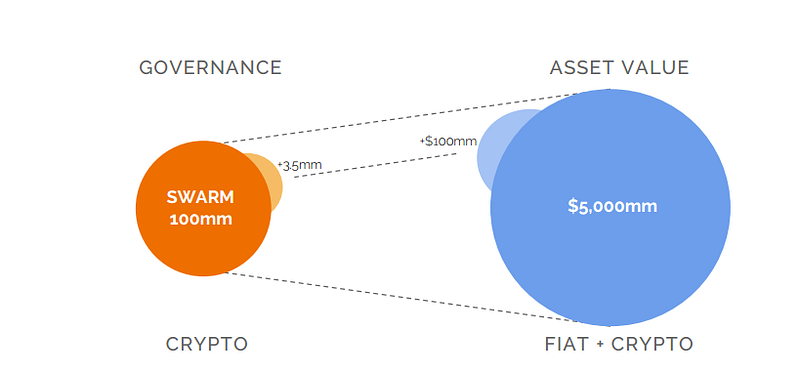

In our token launch, we are projecting to raise $ 50M USD denominated in ETH. For capital allocation, the main principle is that the lesser of 25% of funds raised or $ 20M will go towards operational expenses and platform development. The remaining funds will be deployed towards the initial pilot fund opportunity. That way, a higher fund does not increase budgets for the operation of the foundation, but benefits the implementation and impact of the Swarm model. Our current team members have managed individual portfolios in excess of $ 3B and built platforms with an excess of $ 32B in deal flow. Fund usage will be split between even platform and application development.

TOKEN SWARM

To build this project Swarm Fund offers Token Swarm for public offering on September 7, 2017.

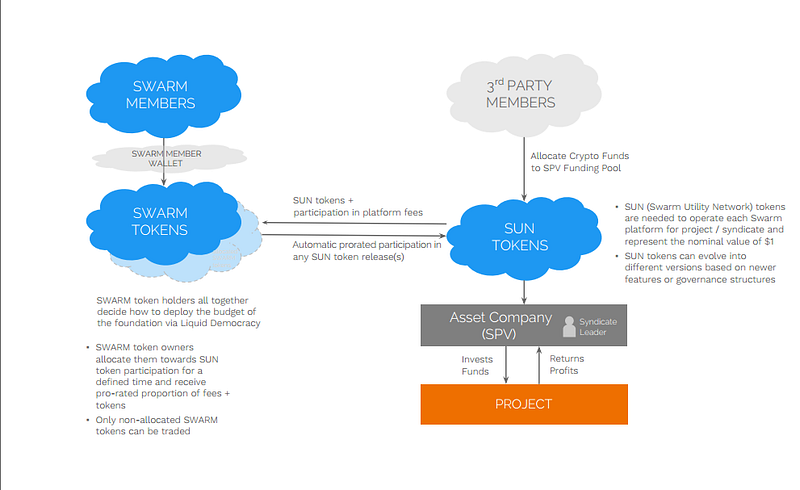

Tokens that are distributed during token launches are known as Swarm Tokens, or SWARM. Utilities opened by the SWARM token are the ability to create sub funds, participate in Swarm project token offerings, gain access to information that is exclusive to our network, and government network execution functions. The participation of all members is the key of the Swam platform. Here is a model pioneered by VISA, SWIFT, and other common consortiums where the infrastructure is managed by members of the organization.

TOKEN MODEL LEVEL

- a utility token that allows access to the basic sub tokens and gives access to Swarm government

technology

- Financial opportunities are run by Swarm syndicate partners and make it possible through their own

applications and Token SUN (Swarm Utility Network)

BASIC STRUCTURE OF SWARM TOKEN

TOKEN MECHANISM

Mark Oei

Until end of 2016, Mark was at Sequoia Capital where he served as Managing Director of the venture capital firm's Heritage Fund, a multistrategy vehicle offering institutional investors and family offices investment exposure to multiple asset classes. As leader of the Real Asset group Mark has been seeking opportunistic real estate investments both domestically and abroad. Earlier, Mark was a managing director of Otsree Capital Management, one of the largest institutional alternative investment managers in the United States, and was VP at Morgan Stanley focused on acquisitions for the Morgan Stanley Real Estate Funds. John Edge John is a capital markets expert and currently Connected Science Fellow at MIT, as well as chairman of Identity2020, a blockchain based platform to make digital identity of basic human rights. Among other positions he was co-founder of RedKite (real-time trading surveillance), head of Electronic Client Solutions EMEA at JPMorgan, EMEA's EMEA Trading EMEA director and LeMman Brothers Portfolio Trading & Advisory EMEA at UBS Investment Bank.

APPLY TO BECOME PART OF THE SWARM ON THE FOLLOWING BASIS:

https://app.swarm.fund/member-registration

Receive tokens which will translate to a tradable ERC20 token and allow you to use our liquid democracy platform

- Access to private in person events, including our crypto-investment seminars which provide tips from top traders and investment managers

- Access to an exclusive crypto related private communication channel for more frequent communication

- Early and privileged access to funds we are setting up, including our crypto-hedge fund

- Number of tokens purchased will be based on the Ethereum Swarm exchange rate at the time of the transaction

- The price of tokens is static till token sale date (Sept 7) after which, it will fluctuate, based on Eth price.

LEGAL AND CO-OP ADVISORS

Houman Shadab

Houman is a professor at New York Law School and the cofounder of Clause.io. He is a prolific and influential expert at the intersection of law, business, and technology. His research focuses on financial technology, smart contracts, hedge funds, derivatives, commercial transactions, and blockchains. Professor Shadab is the director of the Center for Business and Financial Law and also serves as the editor-in-chief of the Journal of Taxation and Regulation of Financial Institutions. He often advises companies and financial institutions on issues relating to compliance, litigation, and operations, and serves on the advisory board of several tech startups. Mr. Shadab has tested before the federal government several times, including before the Commodity Futures Trading Commission on hedge funds at a hearing that included George Soros and other leading figures from the hedge fund industry. He is often invited to speak at highlevel swift academic and practitioner events, including for The Economist, Stanford's Future Law conference, Consensus 2015, the SWIFT Business Forum, and the New York State Bar Association annual meeting.

Robert Rosenblum

Robert Rosenblum is a corporate and securities partner in the Washington, D.C., office of Wilson Sonsini Goodrich & Rosati. Rob focuses on the representation of financial services firms in sophisticated regulatory, transactional, and product development projects, advising them on federal securities laws and related financial services laws and regulations.

PARTNERS

Bitcoin Suisse https://www.bitcoinsuisse.ch We are using Bitcoin Suisse to handle large fiat payments and AML / KYC.

Bitwala https://www.bitwala.com We are using Bitwala's payment processing and banking services for ourselves and our partners.

Otonomos https://www.otonomos.com We use Otonomos to automate the creation of special purpose vehicles and funds in multiple legal jurisdictions.

Aragon https://aragon.network We intend to integrate a liquid democracy module with Aragon's upcoming package manager and to use their application to manage voting.

You are in good hands

Our core team consists of the most qualified professionals with an impressive experience. The Swarm team has managed a bill of $ 25 billion worth of transactions each month.

Website: https://swarm.fund/

Whitepaper: http://sites.swarm.fund/whitepapers/Cooperative-Ownership-Platform-for-Real-Assets.pdf

Made by TahuDiniHari

https://bitcointalk.org/index.php?action=profile;u=1073216

Komentar

Posting Komentar